tax sheltered annuity plan

Content Deferred Compensation 457 Plan Early withdrawals IRC 403b Tax-Sheltered Annuity Plans When can I take money out of my TSA account. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations.

Retirement Nuts Bolts And Pre Tax Accounts Training For Campus Hr Retirement Administrators Ppt Download

IRC 403 b Tax-Sheltered Annuity Plans.

:max_bytes(150000):strip_icc()/Term-p-pension-plan_Final-56c431f7dd174d6a9d32f40aba32f7fb.png)

. So even though this is. A 403b annuity also called a tax-sheltered annuity plan is a retirement plan offered to employees of a tax-exempt entity. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. A tax-sheltered annuity plan gives employees. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. Similar to a 401k offered by for-profit. The UW 403 b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403 b Program allows employees to invest a portion of their income for retirement on.

Typically a Company Sponsor Employer of this type of plan creates an account for every. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income.

It is also known as a 403 b retirement plan and. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Its similar to a 401 k plan maintained by a for-profit.

KAISER PERMANENTE TAX SHELTERED ANNUITY PLAN II is a DEFINED CONTRIBUTION PLAN.

Tax Sheltered Annuity Plans 403 B Plans For Employees Of Public Schools And Certain Tax Exempt Organizations Tax Bible Series 2016 Book 3 Ebook Schaper Alexander Amazon Co Uk Kindle Store

Tax Sheltered Annuity A Term That Should Die Educator Fi

Fiduciary Litigation Best Practices For 403 B Plan Fiduciaries Butterfield Schechter Llp

Solved In A Tax Sheltered Retirement Plan Which Of The Chegg Com

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

403 B Tax Sheltered Annuity Plan Overview Vermillion Financial Advisors Inc

2021 2022 Utsaver Retirement Plans The Best Value By Ut System Office Of Employee Benefits Issuu

403 B Tax Sheltered Annuity Plan Human Resources University Of Nevada Las Vegas

403 B Tsa Dcp Roth Edina Schools Payroll And Myview

Tax Sheltered Annuity Faqs Employee Benefits

Amazon Com Tax Sheltered Annuity Plans 403 B Plans For Employees Of Public Schools And Certain Tax Exempt Organizations Tax Bible Series 2016 Book 3 Ebook Schaper Alexander Kindle Store

403 B Plan How It Works And Pros Cons The Motley Fool

Who Uses A 403 B Plan Part One By Admin Partners Llc Medium

If And When To Borrow From A Qualified Retirement Plan

403b Tsa Annuity For Public Employees National Educational Services

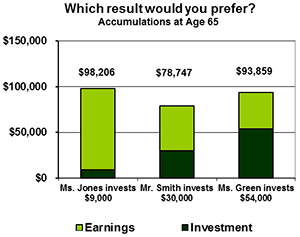

The Importance Of Saving For Your Retirement Ppt Download

What Is A Cash Balance Plan Retirement Savings Beyond A 401 K